The relentless hum of mining rigs, once a niche sound resonating in tech-savvy basements, now echoes across massive data centers, a testament to the ever-evolving landscape of cryptocurrency mining. Bitcoin, the pioneering digital asset, remains the lodestar, pulling ambitious entrepreneurs and seasoned investors alike into its computationally intensive orbit. As we hurtle toward 2024, the question isn’t *if* Bitcoin mining is profitable, but *how* to maximize those profits, starting with the right hardware. Selecting the optimal mining rig is no longer a matter of simple preference; it’s a strategic imperative dictating efficiency, profitability, and ultimately, survival in this fiercely competitive arena.

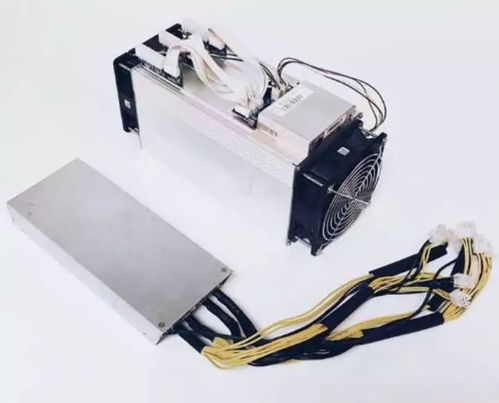

The allure of digital gold has spawned an entire ecosystem of mining hardware, each vying for dominance in hash rate, power efficiency, and overall ROI. Forget the days of repurposed gaming GPUs. Today’s Bitcoin mining landscape is dominated by Application-Specific Integrated Circuits (ASICs), custom-designed chips engineered to perform the SHA-256 algorithm – Bitcoin’s cryptographic backbone – with unparalleled speed and efficiency. But navigating this complex market requires a discerning eye, an understanding of the key metrics, and a dash of future-proofing.

Before diving into specific recommendations, let’s dissect the core criteria. Hash rate, measured in terahashes per second (TH/s), quantifies the rig’s computational power – its ability to solve complex mathematical problems and earn Bitcoin rewards. Power efficiency, expressed in joules per terahash (J/TH), reflects how effectively the rig converts electricity into hashing power. Lower J/TH values equate to higher profitability, especially as energy costs continue their inexorable climb. Cost, of course, remains a crucial factor, but remember that a lower initial investment can quickly evaporate due to higher electricity consumption or lower hash rates. Finally, consider the manufacturer’s reputation, warranty terms, and the rig’s long-term reliability.

Several contenders are vying for the top spot in 2024. Industry whispers suggest that Bitmain’s Antminer S21 series is poised to redefine efficiency standards, promising impressive hash rates with significantly reduced power consumption. MicroBT’s Whatsminer M50 series remains a strong contender, known for its robust build quality and consistent performance. And emerging players like Canaan are pushing the boundaries of innovation with their Avalonminer series, incorporating advanced cooling technologies to enhance longevity and stability.

But simply acquiring the latest and greatest hardware isn’t a guaranteed path to success. The profitability of Bitcoin mining is inextricably linked to the global Bitcoin network hash rate. As more miners join the network, the difficulty of solving blocks increases, diluting individual miners’ rewards. This necessitates a strategic approach, encompassing factors beyond the mining rig itself.

Mining pools offer a solution, allowing individual miners to pool their resources and share the rewards proportionally. Choosing the right pool can significantly impact profitability. Factors to consider include pool fees, payout frequency, server location, and security measures. Furthermore, the cost of electricity remains a major determinant of profitability. Regions with access to cheap and renewable energy sources offer a distinct advantage. This has fueled the growth of industrial-scale mining farms strategically located near hydroelectric dams and geothermal plants. In some cases, mining farms are utilizing otherwise wasted energy sources, like natural gas flaring, turning a liability into a profitable asset.

The geographical distribution of mining power is another crucial aspect. While China once dominated the Bitcoin mining landscape, regulations have shifted the epicenter to North America and other regions. This decentralization is generally viewed as positive for the network’s overall security and resilience.

The rise of alternative cryptocurrencies like Dogecoin and Ethereum introduced new dimensions to the mining equation. While Bitcoin mining relies exclusively on ASICs, other cryptocurrencies utilize different mining algorithms, necessitating specialized hardware. Ethereum’s transition to Proof-of-Stake (PoS) has dramatically altered its mining landscape, rendering traditional GPU mining obsolete. However, the emergence of Ethereum Classic and other Proof-of-Work (PoW) cryptocurrencies offers alternative avenues for GPU miners.

Investing in a diversified portfolio of mining hardware, catering to different cryptocurrencies and algorithms, can mitigate risk and capitalize on emerging opportunities. However, managing a diverse mining operation requires technical expertise and vigilant monitoring. The volatility of cryptocurrency prices further complicates the equation. A sudden price drop can render even the most efficient mining rigs unprofitable, highlighting the importance of risk management and diversification.

For many, the complexity and capital requirements of operating a full-scale mining operation are prohibitive. This has fueled the growth of mining hosting services, allowing individuals to rent space and power in professionally managed mining facilities. These services offer several advantages, including reduced upfront costs, lower electricity rates, and expert technical support. However, it’s crucial to carefully vet hosting providers, ensuring their reliability, security, and transparency.

Looking ahead to 2024, the Bitcoin mining landscape is poised for further innovation and disruption. Advancements in ASIC technology, coupled with the increasing demand for renewable energy sources, will continue to drive efficiency improvements. The regulatory environment surrounding cryptocurrency mining remains a wildcard, with potential impacts on profitability and geographical distribution. Navigating these challenges requires a proactive and adaptable approach, staying abreast of the latest technological advancements, regulatory developments, and market trends. The future of Bitcoin mining belongs to those who embrace innovation, prioritize efficiency, and understand the ever-evolving dynamics of this dynamic and transformative industry. It’s not just about the rigs; it’s about the strategy.

The environmental impact of Bitcoin mining is an increasingly important consideration. The energy-intensive nature of the process has drawn criticism from environmental groups and policymakers. However, the industry is actively exploring solutions to reduce its carbon footprint, including the adoption of renewable energy sources, the development of more energy-efficient mining hardware, and the implementation of carbon offset programs. As environmental concerns intensify, sustainable mining practices will become increasingly crucial for the long-term viability of the industry. Bitcoin mining companies that prioritize sustainability will gain a competitive advantage and attract environmentally conscious investors.

Ultimately, success in Bitcoin mining hinges on a holistic approach, encompassing not only the selection of the right hardware but also strategic considerations related to energy costs, mining pools, geographical location, risk management, and regulatory compliance. The landscape is constantly evolving, requiring continuous adaptation and a commitment to staying informed. As we move into 2024, the future of Bitcoin mining remains bright for those who are willing to embrace the challenges and opportunities that lie ahead.

One Comment

In 2024’s crypto frenzy, this guide spotlights sizzling mining rigs with expert tips on efficiency and profitability, but beware hidden pitfalls like soaring energy costs and market volatility—smart mining demands more than hardware!